Semiconductors took the bronze medal in last year’s capital-exports rankings, accounting for $50 billion worth of U.S. exports.

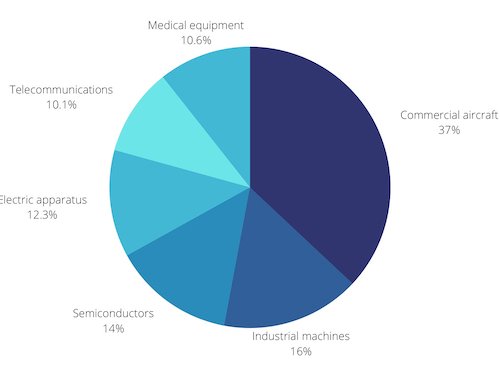

Breakdown of the $547 billion in capital goods exported. Information used courtesy of The Balance

Who’s driving that business? Traditionally, major players like Intel, Texas Instruments, and NVIDIA have been the largest producers of semiconductors in the United States. A number of smaller—though significant—companies have also contributed massively to the industry domestically—and particularly within Texas.

Through investments, corporate relocations, and federal incentives, the Lone Star State is becoming a nexus for semiconductor development. Rivaling Arizona and California, Texas is attracting a number of professionals and fabricators. What factors are sparking this new movement?

The Texas Semiconductor Landscape

While California houses the most chipmaker headquarters nationally, major companies have expanded their operations and set up shop in Texas. Companies like Intel, AMD, and Samsung have historically constructed facilities there to support their evolving needs.

The state is no slouch when it comes to garnering chipmaker interest. While we quickly associate Dallas with Texas Instruments—the state’s largest semiconductor superpower by far—Austin alone has hosted numerous other companies over the years:

- IBM

- Arm

- Micron

- Cirrus Logic

- Micron

- Freescale (acquired by NXP)

- NXP

- onsemi

- Cypress Semiconductor (acquired by Infineon)

- Infineon

- Maxim Integrated (acquired by Analog Devices)

- Altera (acquired by Intel)

While not an exhaustive list, there’s a clear precedent behind what’s currently developing in Texas.

Micron's facility in Allen, Texas. Image used courtesy of Micron

Though many facilities statewide have come and gone with time, many still remain operational—either to produce more chips, design new components, or accelerate R&D. Texas is home to over 200 semiconductor manufacturing facilities, and this quantity is expected to grow.

State-specific Advantages

Why has the state been such a destination for corporations? If you ask the governor’s office, Texas boasts a climate that’s highly business-friendly and an economy that would rank it ninth internationally as a country. Texas also has no corporate or personal income taxes.

Additionally, the state has the human capital necessary for business success. Texas claims the country’s second-largest workforce totaling a whopping 14 million. It’s the top state for population growth nationally. The state’s collegiate academic system is also robust—with over 2.21 million total students. Approximately 183,000 are studying the following disciplines:

- Computer and information sciences

- Engineering technologies and related

- Engineering

There’s a massive pool of talent available locally, especially centered around Dallas, Austin, and Houston. Manufacturers aren’t struggling to find engineers, designers, quality assurance staff, or other essential fab employees. That might not be the case in other states where workforce sourcing is challenging.

Finally, Texas is huge. The state has 268,597 square miles of landmass, and much of that is ready for corporate development. Foundries and semiconductor facilities are sizeable in their own right—and the state’s plains regions offer a good foundation. Its location and infrastructure are also conducive for serving domestic or global customers. Large numbers of seaports, airports, and railways make it easy to move products around. They also make it easier for fabricators to procure raw materials so critical to chip manufacturing.

Texas Instruments Plans Four New Fabs

First, a few big names in the field have promised significant investments within Texas. Texas Instruments (TI) plans to kick off construction on four new fabs atop a central site in Sherman. Costing an estimated $30 billion overall, the project could add roughly 3,000 new jobs following its 2025 completion.

Rendering of TI's 300 mm semiconductor wafer fabs in Sherman, Texas. Image used courtesy of Texas Instruments

The plants will manufacture 300 mm wafers. Other facilities producing those same wafers have focused on analog and embedded-processing components. The array of components produced at these new plants is indeterminate; they may also diversify over time. There’s an acknowledged increase in need within automotive and industrial markets, however. By localizing key links in the semiconductor supply chain, TI hopes to become more self-sufficient.

Samsung Bolsters Its Lone Star Presence

Samsung has recently committed to building its new $17 billion advanced chipmaking plant in Taylor—just 30 miles outside of Austin. Construction on the 1,200-acre facility will begin next year and extend into 2024. Samsung hopes to add roughly 1,800 jobs with its latest investment while supplementing its other Texas facilities. Its chips will support both customer devices and Samsung’s own devices moving forward.

From left to right, Sen. John Cornyn, Gov. Greg Abbott, Samsung Electronics Vice Chairman and CEO Kinam Kim. Image used courtesy of Samsung

Though the $52 billion CHIPS Act has yet to clear the House of Representatives, Taylor is offering its own incentives. Massive property tax breaks exceeding 90 percent will significantly lessen financial burdens for ten years. For Samsung, the facilities are a long-term investment in next-generation engineering. The company may produce its 3nm chips there soon while serving customer requests simultaneously.

Tesla Moves Its Headquarters

COVID has put a massive strain on chip manufacturers and component makers alike. In many states, public-health guidelines and restrictions have impacted how companies resume operations. This has been the case for Tesla, according to CEO Elon Musk. Now, Tesla is officially moving its headquarters to Austin—in a state where COVID restrictions have been less stringent than those in California.

The company’s Gigafactory site seems to be the destination for this new headquarters. It’s expected to span roughly 2,000 acres and be open to the public.

Tesla's Gigafactory in Austin, Texas. Image used courtesy of Austin American-Statesman

Tesla is soon designing its own chips to power its self-driving vehicles, and these components are central to the company’s AI-based plans. These processors enable better user experiences and real-time environmental analysis while on the road.

A New Texas Technology Task Force

While private companies form the backbone of the Texas-based semiconductor industry, federal involvement is also key. In a bid to help the state draw investment, Governor Greg Abbott has formed a new semiconductor task force.

The group consists of private sector members, universities, and community partners directly involved with technological advancement. The goal? Make the U.S. Department of Commerce an offer it can’t refuse—cementing Texas as the landing site for the government’s National Semiconductor Technology Center and the National Advanced Packaging Manufacturing Program. A well-reasoned proposal lies at the center of this movement.

Sen. John Cornyn touring Samsung's Austin fab with Jon Taylor, Samsung's VP of fab engineering. Image used courtesy of Austin American-Statesman

The CHIPS for America Act has paved the way for these institutions. While the bill has passed in the Senate, congressional lawmakers have yet to give their final stamp of approval. The Act arose as companies and the federal government aimed to mitigate global chip shortages. Abbott and the task force hope that Texas can help America become more self-sufficient.

Texas’ technological prowess is a great asset in its fight to secure federal investment. It represents a unified effort to supercharge chip production. The task force also hopes to bring thousands of new jobs to the table in the coming years.

The Future, Though Uncertain, Looks Bright

The future of semiconductor production and research in Texas is promising with its mix of existing and prospective advantages. Statewide power outages have also illustrated just how massive the semiconductor industry is within.

A significant 32 percent of FAANG professionals believe that Texas will be the next Silicon Valley. There’s a palpable buzz around the state’s prospects. Will semiconductor manufacturers continue to buy in?