In its latest series of memory announcements, Micron initiated phase one of its mega-plan to invest $150 billion in global semiconductor manufacturing in the next decade. The plan is set to move forward in phases.

Rendering of Micron's new fab plant in Boise, Idaho. Image (modified) courtesy of Global NewsWire

Phase one comes in the wake of the historical sign-off of the CHIPS and Science Act (CHIPS+ Act), which ensures government funding and tax credit incentives for chip manufacturing companies. This funding will help chipmakers to build new fabs, increase R&D capacity, strengthen the job sector, and cement the U.S.' central position in the world’s semiconductor manufacturing industry.

Micron Steps Up to Boost Domestic Supply

Micron, which is among the world’s top chipmakers and the only one in the United States to make advanced memory and storage semiconductors, will invest $15 billion in a new fab located in Boise, Idaho. By 2030, the new fab will create 2,000 new jobs at Micron and 17,000 new jobs in side sectors, including logistics, transportation, and construction.

Micron has a 40-year history of R&D investment and creating job opportunities in the area, having invested $3 billion in R&D only in 2021 and already employing 6,000 people. The company has more than 47,000 thousand patents under its name and an R&D network spreading across 17 countries. Beyond its Boise headquarters, the company has a manufacturing site in Manassas, Virginia, and a brand new Memory Design Center in Atlanta, Georgia.

Building Capacity from Square One

The new fab will be in the vicinity of the company’s headquarters and its well-developed R&D center, creating an interdisciplinary conglomerate that will research, design, and make chips in a joint educational and corporate effort.

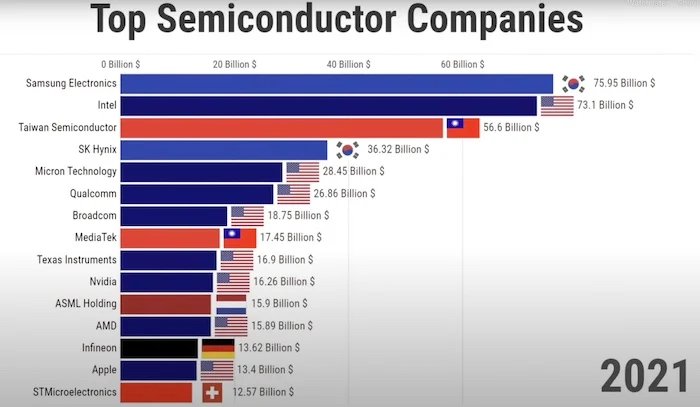

Micron is one of the world's top semiconductor manufacturers. Screenshot used courtesy of Statistics and Data

New fabs birth new jobs and new jobs require qualified candidates with innovative degrees. To enrich its talented workforce from the ground up (and for years to come), Micron will invest in K-12 STEM education and help working parents with a nearby childcare facility. Additionally, the company has partnered with the College of Western Idaho to design a new curriculum for the Advanced Mechatronics Engineering Technology degree to pave the path for students who want to join the Micron Technician Apprenticeship Program.

Far-flung Support for the New Fab

This initiative is one of the largest public-private partnerships in industries of vital interest in U.S. history. Micron's plan has garnered support from state government officials, and the company has received access to federal funding and credits granted by the CHIPS+ Act. The new fab is also endorsed by Idaho Power, the state's electrical utility provider.

Micron is one of the few companies that got the green light to fuel up private resources and benefited from the CHIPS+ Act's initial roll-out. In fact, it wouldn't be possible to build this new fab without the new legislation. New fabs cost billions and are slow to bring profit—and they cost even more in the U.S. market. It is 35-45% more expensive to build a new fab in the U.S. than it is to do the same in more affordable markets.

However, the newest legislation targets the semiconductor industry and to a broader extent, modern sciences dependent on electronics. This legislation aims to extend technological advances to national security and supply chain resilience.

The National Importance of Memory and Storage

Another advantage that has put Micron in a position to build a new fab is the company’s record of successes in both DRAM (memory-related) and NAND (storage-related) technologies.

6th-gen NAND 232-layer storage technology by Micron. Image courtesy of Micron

Memory and storage play a crucial role in the development and adoption of 5G devices, distributed information technology such as edge computing, and widespread AI applications across various industries, including intelligent automotive networks, IoT, and data centers.

Back in August, Micron announced that the next steps of the semiconductor development plan backed up by the CHIPS+ Act will include $40 billion in private investment with prospects for 40,000 new jobs, out of which 5,000 new roles will be at Micron, so there is more to come in terms of where the money will go.

This fab will be the first significant drop in the bucket to address the chip shortage. The U.S.' share in global manufacturing has dropped to as low as 2%, and the next decade is crucial in regaining its previous leadership position.

SK Hynix Redirects from Abroad to Stimulate Manufacturing

Memory and storage are global priorities for chip manufacturers, and U.S.-based companies are not the only ones to look for investment opportunities despite the global economy being laden with uncertainty. SK Hynix, a leading South Korean manufacturer of modern NAND storage devices, has remained solid in tough times and has just announced the building of a new M15X fab plant in the Cheongju Technopolis industrial complex. The building of the plant will start in October 2022 and be finished by 2025. The total investment costs $15 trillion.

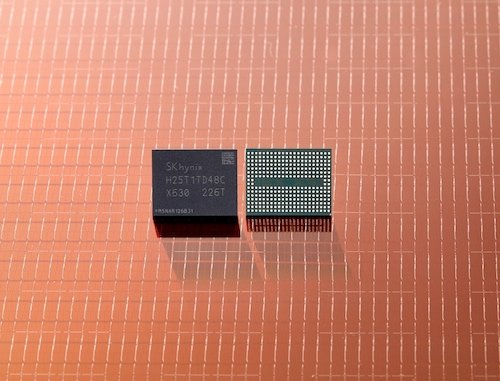

238-layer 4D NAND flash by SK Hynix. Image courtesy of SK Hynix

Following the U.S.' decisive stance to reduce outsourcing to China and promote domestic semiconductor manufacturing, global partners such as SK Hynix and Samsung have made moves to shift their focus from Chinese investments and strengthen their business relations with the U.S. Both companies have announced building sites in U.S. locations.